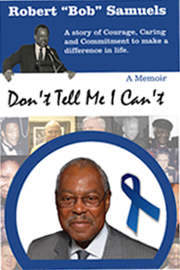

Life After Chase: Robert (Bob) Samuels

Life After Chase: Robert (Bob) Samuels

Banker, Advocate, Pioneer

Bob Samuels is twice a pioneer – as one of the first generation of black bankers and as a national advocate for prostate cancer research and awareness.

As he now speaks around the country and signs copies of his memoir, Don’t Tell Me I Can’t, he also seems to be rivaling either a cat or Rasputin for his number of lives: at 73, Samuels has survived poverty, alcoholism, depression, sex addiction, advanced stage prostate cancer, spinal fusion, diabetes, throat cancer and, diagnosed just this last year, small cell cancer.

Don’t tell him he can’t.

Born in Philadelphia to a “16-year-old girl from the ghetto”, Samuels was raised by his grandmother, a housekeeper who scraped up the $15 a month – a colossal sum for her – to send him to parochial school. He enlisted in the U.S. Air Force in 1956, and was honorably discharged in 1960. He attended the American Institute of Banking, New York Institute of Credit.

In 1962 he began his career in finance at Household Finance Company in Philadelphia, and, in 1964, joined First Pennsylvania Bank and became their first black loan officer. In 1969 Samuels joined Manufacturer's Hanovers Commercial Loan training program in New York City. He stayed with Manny Hanny until the Chemical merger in 1992, retiring at the age of 52 as a Vice President in the Global Financial Institutions Group, a division of the Corporate Banking and International Sector.

By then disillusioned by his not having moved into senior management, Samuels thought, “I don’t have to play human PacMan.”

Samuels said he lost two-thirds of his pension by retiring at 52. Many a colleague, he said, told him, “Bob, you could go further if you weren’t dragging all that black baggage with you.”

But he said his motivation was never money.

“I am part of a generation that directly benefited from the Civil Rights movement,” Samuels said. “We were part of the struggle and witnessed the sacrifice of limbs and lives to make sure our generation would have opportunities that had been denied black people in America. We knew our generation's job was to go through the doors that had been opened, to show we could perform and reach back to help others come through the doors, too.”

“There were probably 15 trainees in my cycle at Manny Hanny: one woman, one black – me – one Jewish and the rest all Anglos,” Samuels recalled. “There were other blacks around the bank, but no officers.”

Post-training, he was assigned to the Union Carbide branch at 270 Park Avenue.

“I really didn’t get exposed to real discrimination until I went out on line assignments, and then you get exposed to the rest of the bank,” Samuels remembered. “It was mostly attitudinal. I recall calling Operations downtown on behalf of a client and being told, ‘Well you know we’ve had all sorts of problems since we started hiring those people’. They called us ‘affirmative action babies’. I made a point of going downtown to introduce myself, to let them know exactly who they were dealing with.

“I experienced subtle racism with customers as well as people within the institution,” Samuels continued. “I’d go calling on a client and the receptionist would tell her boss, ‘Mr. Samuels is here.’ The boss would come out and look

over and through me, wondering where Mr. Samuels was. They thought I was lost or the driver.”

Samuels had been at the Union Carbide branch for about a year when he was summoned to see Robert E. (“Jeff”) McNeill, Jr., chairman of the bank, at 350 Park Avenue. “McNeill was a big, tall, gangly Southerner, who told me he’d received a request for someone to lecture at an all-black college in Florida, not far from where he’d grown up. I went as an adjunct professor, along with his $5,000 check to be given to deserving students.

“It was my first time ever going on a campus of a black college,” Samuels continued. “I was the first black banker they’d ever met. When I asked them if they’d considered going into banking, the answer was ‘we don’t want to be no teller.’ I realized how lucky I was to have been raised up north. They had no idea of the real world. It was a great three-day experience for me, and when I came back to New York I told McNeill that if he any other opportunities like this,

Samuels started getting so many requests that his senior manager at the branch asked Samuels if he was working for the branch or for the Chairman. Samuels was soon posted as a staff officer to the Chairman’s office.

Samuels helped set up a Department of Public Responsibility at Manny Hanny, dealing with inner city lending, training programs and grants to organizations, among other areas. When John Price, President Nixon’s special assistant for urban affairs, was brought in to run the department, Samuels figured it was time to return to a line job.

He was assigned as second in command at the Madison and 42nd Street branch, serving middle market companies. A year later, he was asked to transfer to corporate banking at 40 Wall Street – the first black going into the corporate banking group. He worked with such companies as American Express, Dow Jones and AIG and ultimately became a team leader.

The bank sent him to the Stonier Graduate School of Banking at Rutgers, a sure sign he was being groomed for senior management. Of the five vice presidents sent by Manny Hanny, only Samuels and one other completed the program, partly because the bank didn’t give time off to write the thesis required for a degree. Samuels’s thesis was on the changing insurance industry.

“I never got that call to senior management,” Samuels said. “I kept on being told, ‘be patient’. I didn’t see overt discrimination, but if you were the son or daughter of someone important, rich or privileged, your chances were better. The group that came behind us were white females. They were the greatest beneficiaries of affirmative action. As I say in my book, they all seemed to be named ‘Mary Sue, Mary Beth, Mary Ellen’ – and all looked like cheerleaders. They seemed to move ahead of us…but you couldn’t prove stuff like that.”

Asked whether his self-acknowledged drinking problem might have held him back, Samuels said the nature of his banking career contributed to his “out of control” behavior.

“When I was a staff officer for three years, I could come and go as I chose

I’d come drifting in – that may have contributed to it,” he said. In line jobs, he added, “We were expected to take a client or prospect to lunch every day. That meant two martinis and then come back to the office, and then in the evening wine, dine and entertain more clients,” Samuels said. “I didn’t realize at that time you can get addicted to that, and I fell in love with that life.”

He said he saw a number of fellow officers who, one hangover too many, had to be retired.

Despite his disappointment – or perhaps because of it – Samuels approached a highly supportive John McGillicuddy, McNeill’s successor, about creating an organization where black officers could communicate with each other about issues facing them in the banking industry, so that, in Samuels’s words, they wouldn’t feel “so alone”.

This led to Samuels’s becoming the founding president of the NYC Urban Bankers Coalition in 1971.

“When I did my press release for my book,” Samuels said, “I was contacted by someone I hadn’t heard from in more than 30 years, a black bank officer who had worked for Citi. He wrote me, ‘You may recall I was among the early members. Well I got lots of grief for it from my senior officers. ‘Why was I joining this group?’ I felt they wanted to fire me, and would have except one senior officer came to my defense.’ They thought we were going to form a union or an NAACP chapter or something.”

A few years after founding the NYC coalition, Samuels became founding president of the National Association of Urban Bankers, which has grown to 25 chapters and nearly 3,000 members. In 1984, the National Association of Urban Bankers would honor him by renaming the "Outstanding Banker of the Year Award" to the "Robert J. Samuels Founder's Award". And in 1998 the Urban Bankers further honored Samuels by having his likeness placed in the Great Blacks in Wax Museum in Baltimore. In December of that year he was also inducted into the Black Hall of Fame in Philadelphia.

Meanwhile, for more than 20 years, Samuels had served as a visiting professor for the National Urban League's Black Executive Exchange Program and lectured at colleges around the country. In 1986, New York’s Governor Mario Cuomo appointed him to serve on the Board of Trustees of the New York State Higher Education Services Corporation. He was one of the founders of the Harlem YMCA's Black Achievers in Industry Program and had established the United Negro College Fund's Corporate Matching Gifts Program. As a result of his work with the United Negro College Fund, he was awarded its Outstanding Citizen's Award.

He had been divorced, fathered three sons – one in his marriage, two outside – and was feeling burnt out when the Manny Hanny/Chemical merger was announced and retirement packages were being offered.

“Exit stage left,” said Samuels.

He decided to move to Tampa, where he’d purchased a home in 1981 and where he had an aunt and uncle.

“It was time for me to slow down, to get accustomed to living in a house again, to

become a regular person,” Samuels said about his early retirement.

During his second year in Tampa, he did some part-time consulting for the Tampa Chamber of Commerce. In August 1994, he was having lunch with one of his Chamber colleagues, who had just been diagnosed with prostate cancer.

“After that lunch, I called my doctor and asked him if he had checked my PSA [prostate-specific antigen],” Samuels recalled. He went for blood tests and was found to have a PSA of 46. (Anything over 20 is considered significantly elevated.)

A first biopsy didn’t find anything. His doctor wanted him to go into the hospital for additional tests. “They found it – and I was told I had advanced prostate cancer,” said Samuels. He was 56.

“There were all these treatments, and you as a patient are expected to pick one,” he said. “I set out on a mission to learn about the disease, and learned that a lot of friends had been treated but kept it private. ‘You guys not talking are going to kill the rest of us,’ Samuels told his friends. “The buck stops with me.”

He got the Tampa Bay Area Cancer Group to address the issue prostate cancer. He raised money and got the downtown Tampa Library to create a men’s cancer resource center. He recruited other survivors and with them went around to Rotary and Kiwanis and other fraternal clubs to talk about their experience.

In 1996, Jon Huntsman Sr. invited a group of prostate cancer activists to come to Las Calinas, Texas to create the National Prostate Cancer Coalition. Among the big name attendees were Michael Milken and General Norman Schwarzkopf.

“There was a lot of dueling testosterone in the room,” Samuels recalled with a chuckle. “Each group was vying as the oldest, the largest. Jane Reese-Coulbourne, a leader of the National Breast Cancer Coalition, told us, ‘You’re doing the same thing we did when we set out…allowing organizational affiliation to get in the way of fighting a disease.’”

“We realized that AIDS research was being funded at the $1 billion level…breast cancer at $500 million, and prostate cancer at $80 million – yet prostate cancer had the highest incidence of all three. But the others were organized, we were not.”

Huntsman asked Samuels to be the first president of the National Prostate Cancer Coalition (now called Zero – The Project to End Prostate Cancer).

In July 1996, Samuels found himself leading an organization without staff or an office. Milken offered a challenge grant and eventually found the coalition office space in Washington, DC. Samuels stepped down and formed the Florida Prostate Cancer Network, so he could remain in Tampa. (A year after he went through treatment for prostate cancer, Samuels remarried.)

Florida, he noted, has the second highest incidence of prostate cancer in the country. (“We export youth and import age,” Samuels noted.) California has the highest incidence, incidentally, and New York comes in third.

Despite a succession of health woes, Samuels remains upbeat and active at 73. He’s traveling for book signings (listed on his web site), or you can order books online. He autographs all copies, and the book is now in its second printing of 500 copies.

Don’t tell him he can’t!