A Century in the City, 1887-1987 | Part 2 | Part I

Brochure celebrating Chase Manhattan's first 100 years in London

Thank you to Allan Wright, former chief teller at the London bank at Berkeley Square, for providing the brochure. Due to limits to image resolution on our website, we have provided the text separately. In order to maintain the layout, we recommend looking at this on a desktop or laptop (not on a tablet or phone). No credits were given in the brochure, so we do not know its author or original designer.

Berkeley Square

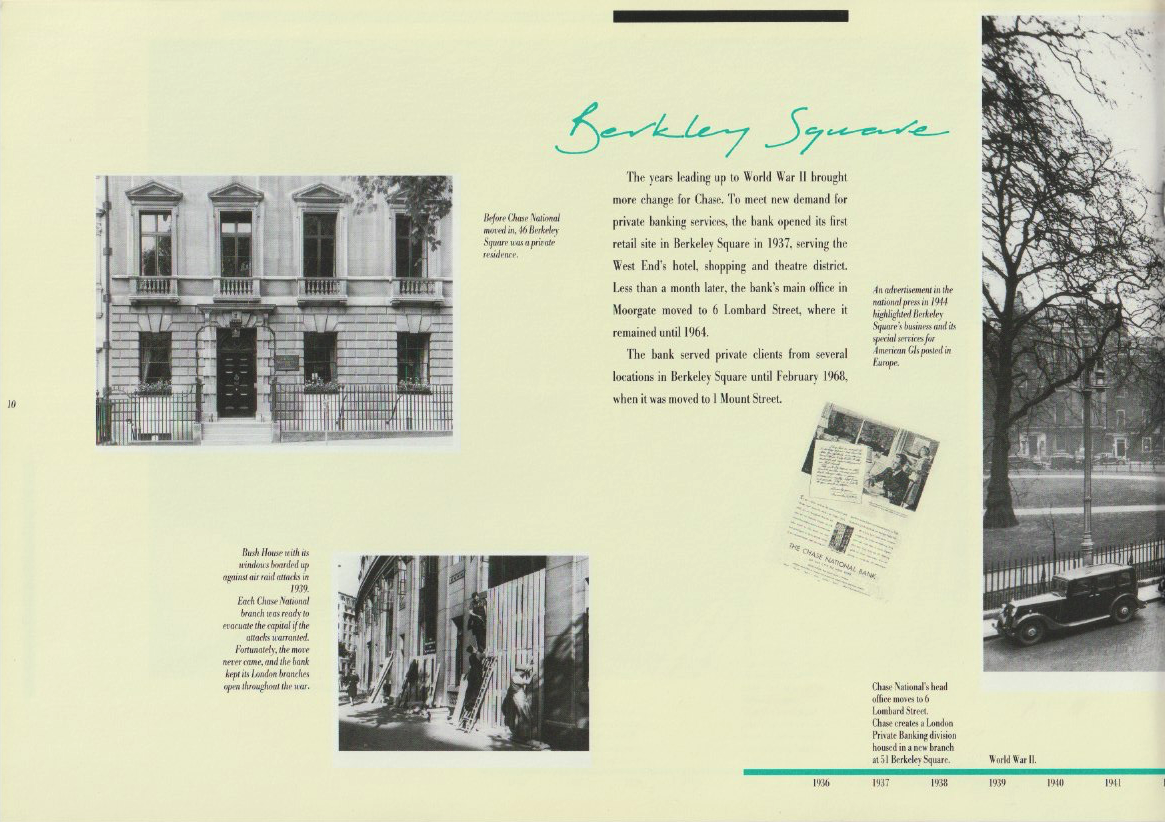

The years leading up to World War II brought more change for Chase. To meet new demand for private banking services, the bank opened its first retail site in Berkeley Square in 1937, serving the West End's hotel, shopping and theatre district. Less than a month later, the bank's main office in Moorgate moved toe 6 Lombard Street, where it remained until 1964.

The bank served private clients from several locations in Berkeley Square until February 1968, when it was moved to 1 Mount Street.

Caption upper left: Before Chase National moved in, 46 Berkeley Square was a private residence.

Caption lower left: Bush House with its windows boarded up against air raid attacks in 1939. Each Chase National branch was ready to evacuate the capital if the attacks warranted. Fortunately, the move never came, and the bank kept its London branches open throughout the war.

Caption : An advertisement in the national press in 1944 highlighted Berkeley Square's business and its special services for American GIs posted in Europe.

Photo cut in two in centerfold -- Berkeley Square.

Timeline:

1937: Chase National's head office moves to 6 Lombard Street. Chase creates a London Privvate Banking division housed in a new branch at 51 Berkeley Square

Embracing New Opportunities

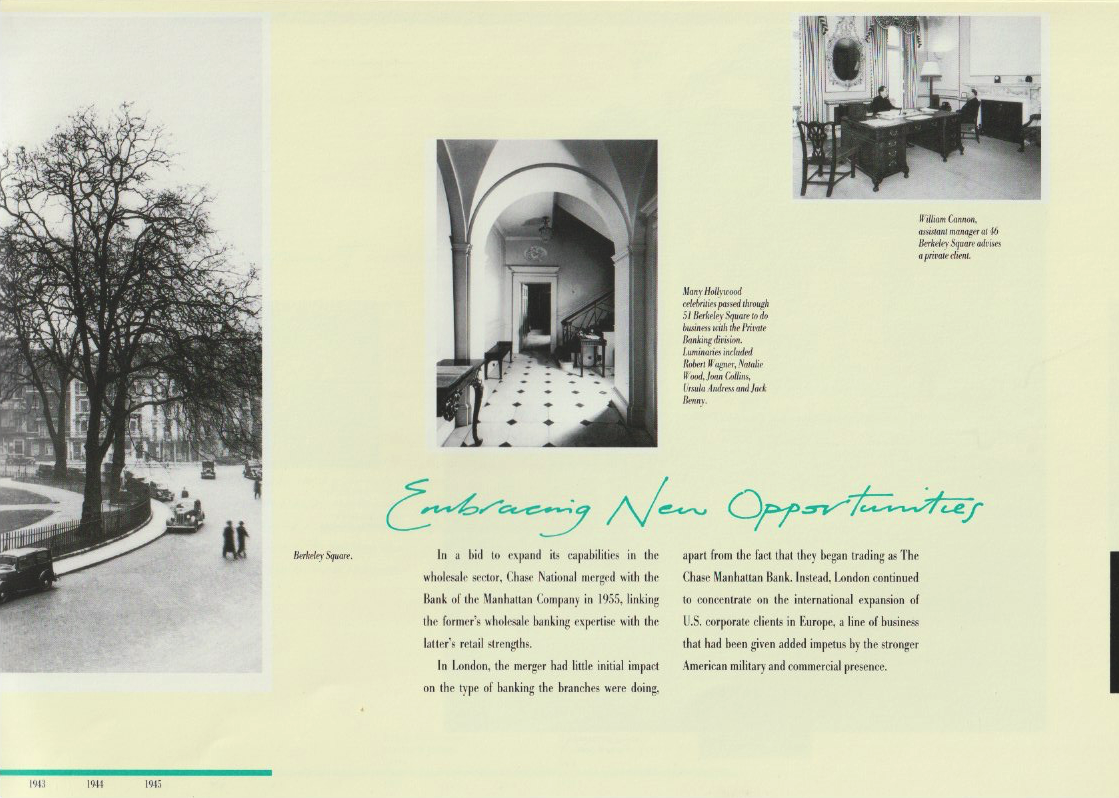

In a bid to expand its capabilities in the wholesale sector, Chase National merged with the Bank of the Manhattan Company in 1955, linking the former's wholesale banking expertise with the latter's retail strengths.

In London, the merger had little initial impact on the type of banking the branches were doing, apart from the fact that they began trading as The Chase Manhattan Bank. Instead, London continued to concentrate on the international expansion of U.S. corporate clients in Europe, a line of business that had been given added impetus by the stronger American military and commercial presence.

Top right: William Cannon, assistant manager at 46 Berkeley Square advises a private client.

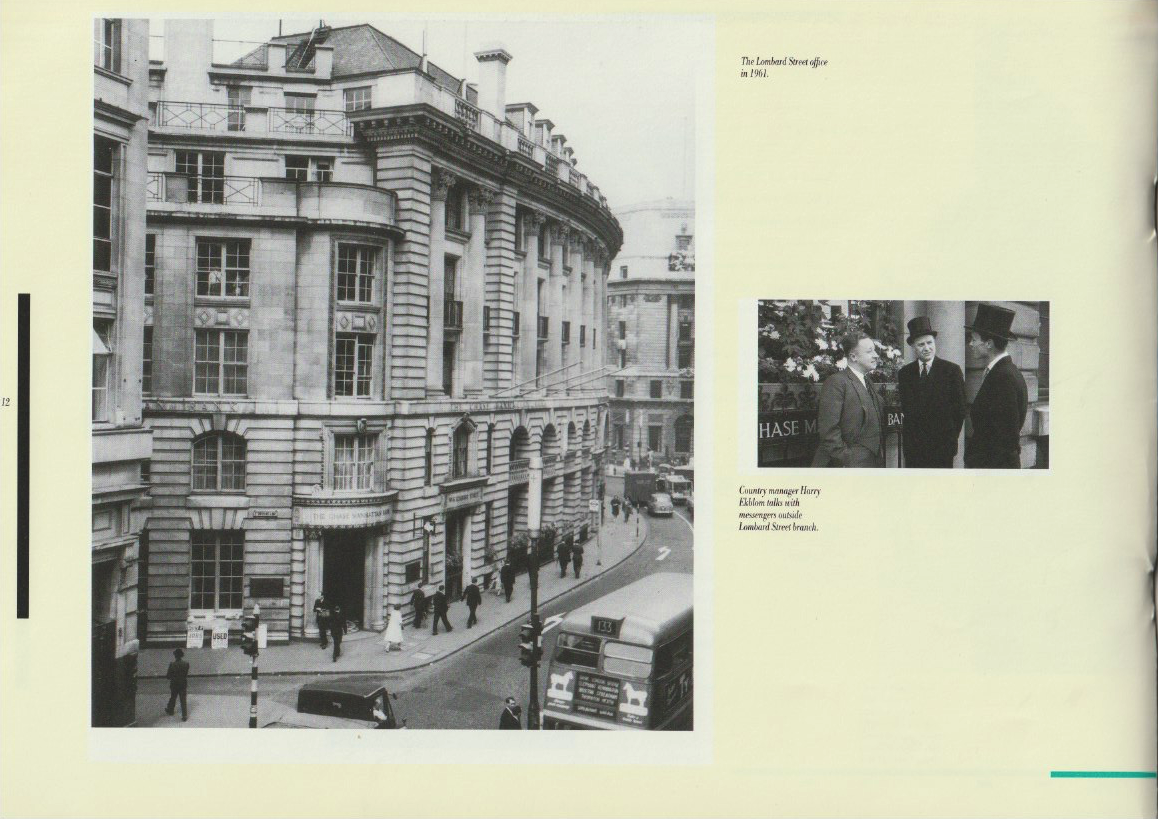

Below: The Lombard Street office in 1961, and Country Manager Harry Ekblom talking with messengers outside Lombard Street branch.

New International Scope

New International Scope

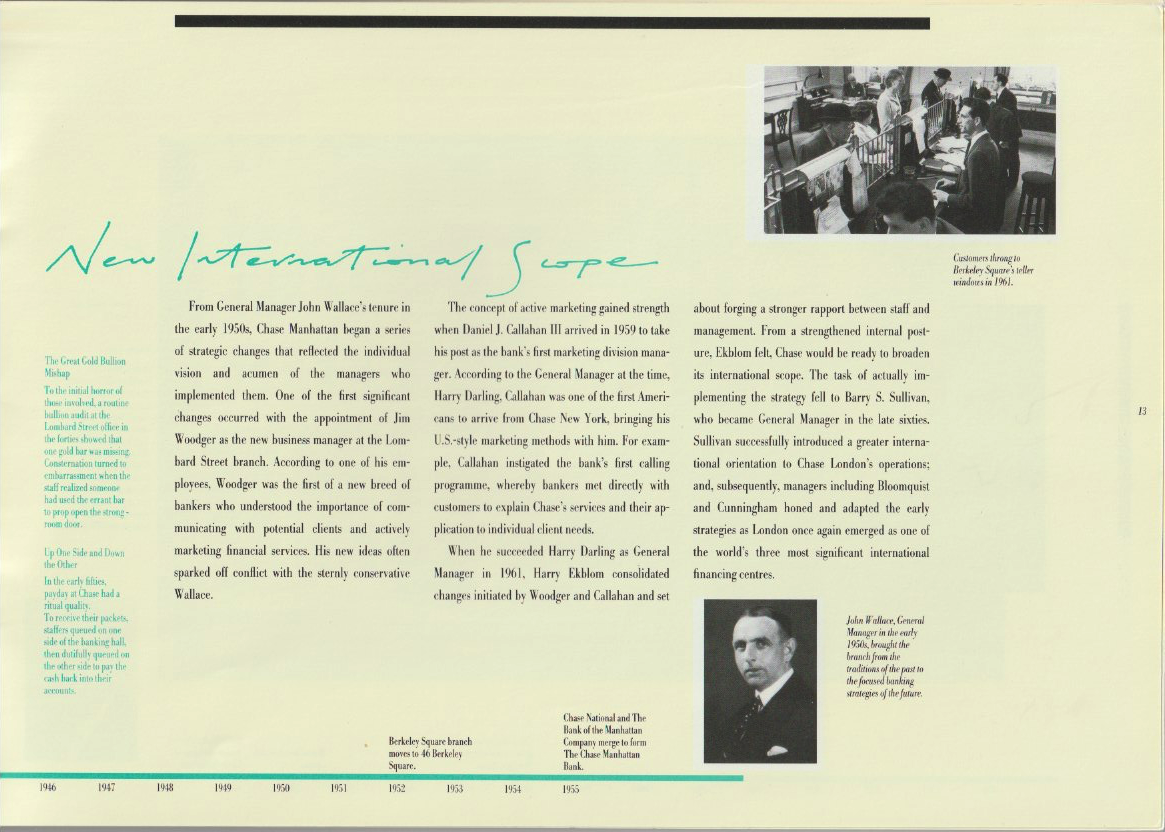

From General Manager John Wallace's tenure in the early 1950s, Chase Manhattan began a series of strategic changes that reflected the individual vision and acumen of the managers who implemented them. One of the first significant changes occurred with the appointment of Jim Woodger as the new business manager at the Lombard Street branch. According to one of his employees, Woodger was the first of a new breed of bankers who understood the importance of communication with potential clients and actively marketing financial services. His new ideas often sparked off conflict with the sternly conservative Wallace.

The concept of active marketing gained strength when Daniel J. Callahan III arrived in 1959 to take his post as the bank's first marketing division manager. According to the General Manager at the time, Harry Darling, Callahan was one of the first Americans to arrive from Chase New York, bringing his U.S.-style marketing methods with him. For example, Callahan instigated the bank's first calling programme, whereby bankers met directly with customers to explain Chase's services and their application to individual client needs.

When he succeeded Harry Darling as General Manager in 1961, Harry Ekblom consolidated changes initiated by Woodger and Callahan and set about forging a stronger rapport between staff and management. From a strengthened internal posture, Ekblom felt, Chase would be ready to broaden its international scope. The task of actually implementing the strategy fell to Barry S. Sullivan, who became General Manager in the late sixties. Sullivan successfully introduced a greater international orientation to Chae London's operations; and, subsequently, managers including Bloomquist and Cunningham honed and adapted the early strategies as London once again emerged as of of the world's three most significant financing centres.

Caption top: Customers throng to Berkeley Square's teller windows in 1961.

Photo below: John Wallace

Timeline:

1952: Berkeley Square branch moves to 46 Berkeley Square

1955: Chase National and The Bank of the Manhattan Company merge to form The Chase Manhattan Bank

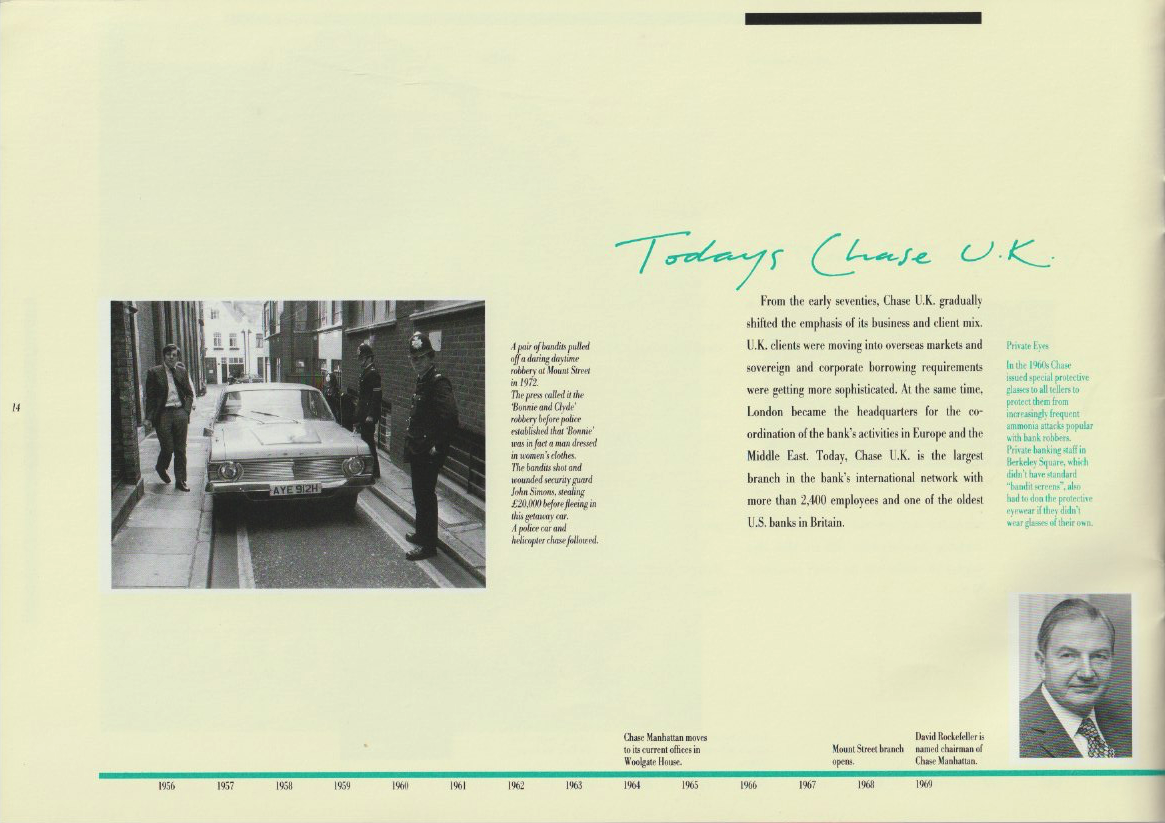

From the early seventies, Chase U.K. gradually shifted the emphasis of its business and client mix. U.K. clients were moving into overseas markets and sovereign and corporate borrowing requirement were getting more sophisticated. At the same time, London became the headquarters for the coordination of the bank's activities in Europe and the Middle East. Today, Chase U.K. is the largest branch in the bank's international network with more than 2,400 employees and one of the oldest U.S. banks in Britain.

Caption, left: A pair of bandits pulled off a daring daytime robbery oat Mount Street in 1972. The press called it the "Bonnie and Clyde" robbery before police established that "Bonnie" was in fact a man dressed in women's clothes. The bandits shot and wounded security guard John Simons, stealing £20,000 before fleeing in this getaway car. A police car and helicopter chase followed.

Below:

From 1964 to the present, Chase's London branch at Woolgate House.

Strong ties at the top: Former Chase Chairman David Rockefeller lends a hand to Prime Minister Margaret Thatcher.

An Investment Banking Revolution

An Investment Banking Revolution

In the 1970s no activity grew more explosively than investment banking. By 1973, the extraordinary expansion of the syndicated loan and Eurobond markets motivated Chase to set up a fully-owned merchant bank, Chase Manhattan Limited (CML), directed by Paul Lakers. Under its second manager, Otto Schoeppler, CML commanded a major role in the thriving Eurocurrency market, which made major strides recycling OPEC surpluses during the seventies.

The Euromarkets explosion of the 1970s resulted in the reshaping of the entire London market in the 1980s. Massive financial deregulation revolutionized the world's oldest financial community, turning London overnight into a freer, more attractive and more international investment centre.

Specifically, The London Stock Exchange deregulated fixed commissions, abolished the former separation of broker and jobber and threw open its doors to foreign members. Chase wasted no time in taking full advantage of the new opportunities.

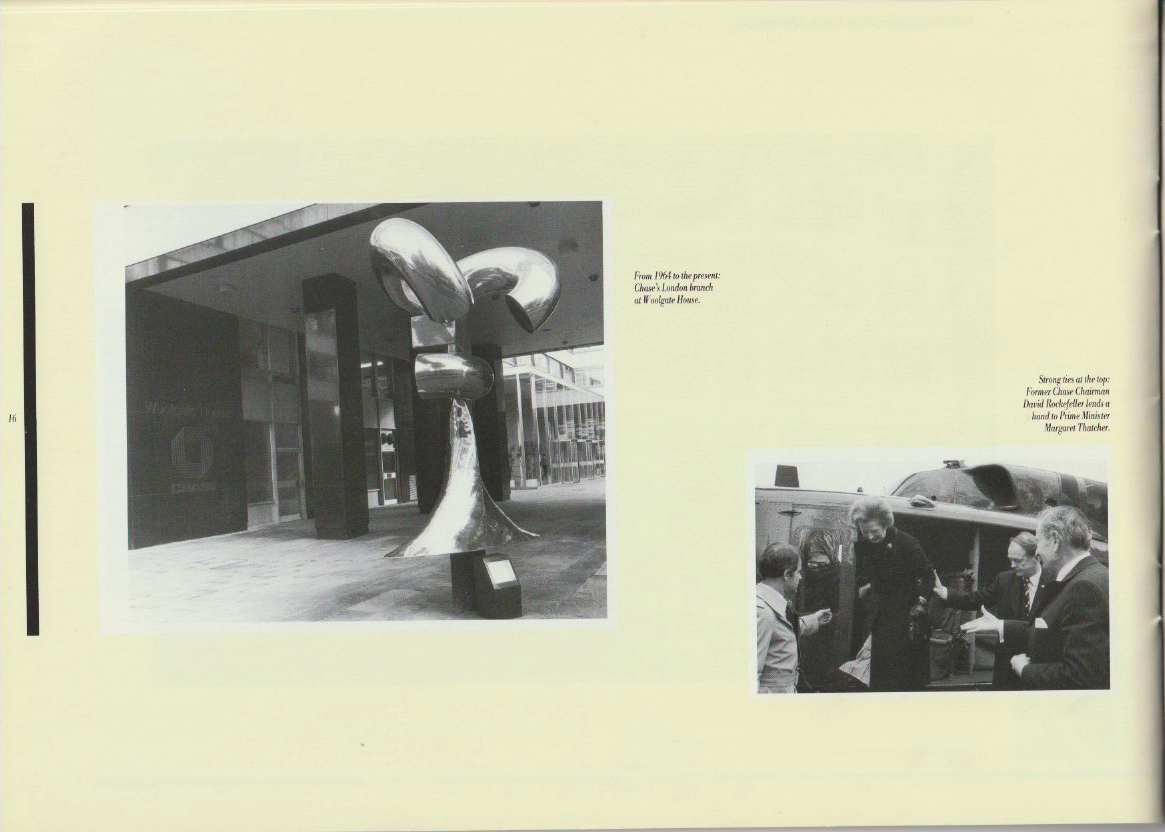

In April 1986, Chase acquired and merged two City stockbrokers, Simon & Coates and Laurie, Milbank and Co., forming a securities traditing oepration of significant size. The new firm, known as Chase Manhattan Securities, developed its own market-making teams in equities and fixed income securities,aligning them with existing foreign exchange and Eurosecurities teams.

Also in 1986, Chase renamed CML Chase Investment Bank Limited (CIBL) to reflect its market focus more accurately. CIBL forges a financing link between corporate and institutional clients and the world capital markets they need to reach via capitalization, asset transformation and risk control services. It forms the ideal complement to the bank's strong wholesale banking relationships and makes the most of the distribution network and market presence of Chase Manhattan Securities.

Ad photo above: NOW A NEW YORK GIANT TEAMS UP WITH THE CITY

With the purchase of stockbrokers Laurie, Milbank and Simon & Coates, the bank built Chase Manhattan Securities, a strong team for London's Big Bang.

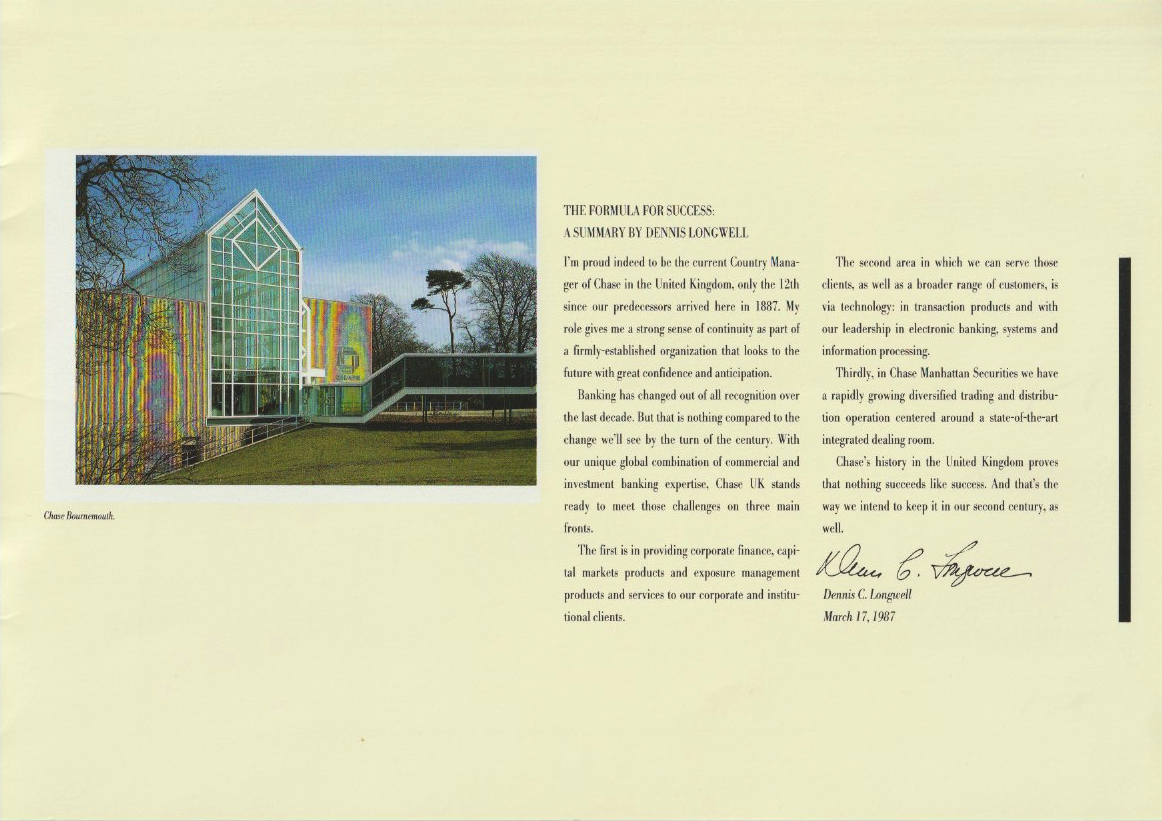

The explosive growth in demand for international financial services in the 1970s and 80s caused a corresponding surge in demand for sophisticated systems support. In order to provide the services its clients wanted, Chase knew it had to create an environment that offered a high level of technology, a flexible workplace and comprehensive back-up for continuous systems availability.

In November 1986, Chae UK moved into its new operations centre in Bournemouth on England's south coast. Chase's most sophisticated systems centre to date, Bournemouth solved serious space, back-up

and electronic delivery problems facing the branch since the early 1980s. More than 700 operations and administration employees people the centre, which provides a highly attractive staff environment and doubles delivery capacity to meet new business needs through the 1990s. The centre also represents a significant hardware and systems investment for payments handling, securities, Treasury and money market product capability.

Chase Manhattan Chairman Willard C. Butcher officially opened the Bournemouth complex in the spring of 1987.