De Wolf of Antwerp and Gouverneur Morris, the "Founding Father" from New York

Research by Smits and Borremans of CAA Antwerp

On the occasion of the 2019 annual luncheon of the Antwerp chapter of the Chase Alumni, Josse Borremans (left) gave a presentation entitled “Which Chase subsidiary laid the foundations of the prime credit standing of the United States?”. The answer was the predecessor bank to Banque de Commerce: De Wolf & Cie. Josse‘s claim was confirmed by financial history scholars at Yale University.

On the occasion of the 2019 annual luncheon of the Antwerp chapter of the Chase Alumni, Josse Borremans (left) gave a presentation entitled “Which Chase subsidiary laid the foundations of the prime credit standing of the United States?”. The answer was the predecessor bank to Banque de Commerce: De Wolf & Cie. Josse‘s claim was confirmed by financial history scholars at Yale University.

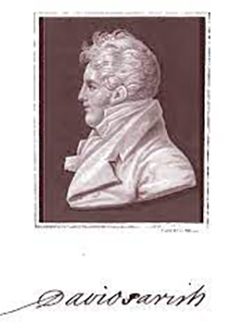

Marc Smits (right) and Borremans became interested in the subject and further explored the relationship between Charles John Michael De Wolf (1747-1806) and the United States. They found a cache of 150 letters, account statements, contracts and prospectuses in the archives of the New-York Historical Society. Most letters were sent by De Wolf to Gouverneur Morris (1752-1816), the “Penman of the American Constitution”, who drafted the Preamble to the Constitution, and, during the period called “the Terror“ (1792-1794), U.S. envoy to France. An additional six letters were sent also to Morris by De Wolf’s widow in the period 1806-1810.

Marc Smits (right) and Borremans became interested in the subject and further explored the relationship between Charles John Michael De Wolf (1747-1806) and the United States. They found a cache of 150 letters, account statements, contracts and prospectuses in the archives of the New-York Historical Society. Most letters were sent by De Wolf to Gouverneur Morris (1752-1816), the “Penman of the American Constitution”, who drafted the Preamble to the Constitution, and, during the period called “the Terror“ (1792-1794), U.S. envoy to France. An additional six letters were sent also to Morris by De Wolf’s widow in the period 1806-1810.

Marc and Josse also searched for Morris’s letters to De Wolf but were unable to find them. They were not in the place where they should logically have been, the archives of Banque de Commerce. Yet in the Library of Congress and the U.S. National Archives, friendly librarians guided Marc and Josse to additional documents, thus enabling the cross-checking of factual information contained in De Wolf’s letters.

These source materials, although incomplete, provide a fascinating insight in the relationship between Charles De Wolf and Gouverneur Morris over the period 1790-1806.

* * *

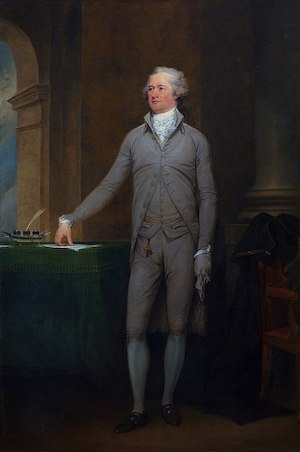

Except for the 1792-1794 period, when he was the U.S. envoy to France, Gouvernor Morris (left) had no official authority. De Wolf and Morris had little in common; Morris was the American equivalent of an aristocrat and highly educated, De Wolf was the son of a middle-class family. His father was a glass maker, his mother, née Wolfs, had inherited some land only suitable for sheep farming but with a valuable resource, white sand, the principal material in glass making.

Except for the 1792-1794 period, when he was the U.S. envoy to France, Gouvernor Morris (left) had no official authority. De Wolf and Morris had little in common; Morris was the American equivalent of an aristocrat and highly educated, De Wolf was the son of a middle-class family. His father was a glass maker, his mother, née Wolfs, had inherited some land only suitable for sheep farming but with a valuable resource, white sand, the principal material in glass making.

Given the era in which they lived, the De Wolfs, as parents, had a method, not common at the time, of passing on their genetic material: They had only one child, whereas large families were the accepted norm. Moreover, they mortgaged their house and workshop to pay for their son’s education. Where Charles was educated and by whom we don’t know, but, given that most of his skills were practical ones, a good private school providing education in commerce and finance is the most probable. Charles had a good command of three languages, accounting, contract law and finance. The latter skill he developed after he was appointed, at the age of 26, as cashier and tax collector for the Province of Antwerp, part of the Duchy of Brabant–an unusual job that didn’t come with a salary but with the right to invest the float of the tax money in the market. Charles De Wolf developed a niche of his own, lending to the elite, especially the high nobility–'Credit’ with a good risk/reward balance.

His job made De Wolf a wealthy man, but he became rich thanks to the American Revolution. After the loss of the 13 American Colonies, Britain was at war with almost all the European powers. The Royal Navy, ruling the waves, seriously hindered trade between Europe and the Colonies as well as with the United States. The merchants of Brabant and Flanders saw an opportunity because they could sail under the neutral flag of the Austrian Empire, respected by all belligerent parties; the Emperor-King was also Duke of Brabant.

De Wolf also seized this opportunity in association with Laurent Solvijns, the leading merchant of Antwerp. Together they set up a special purpose company characterized by shares. They were luckier than most and made considerable profits. In 1780, while the trade was still booming, De Wolf did the unexpected. He withdrew from the trade market and also resigned from his day-job in the “civil service”. (As Chase Manhattan's Bob Hunter wisely used to say, “Leave the last 10 percent to the next guy.”) De Wolf set up his own bank in Antwerp. His business model was copied from the Amsterdam banks, the largest lenders to sovereign states at that time. De Wolf knew that this business would yield large profits because of the up-front fee of 4-8 percent. The Bank also skimmed off the interest payment. De Wolf continued to lend to the elite, who also became regular participants in his deals.

As the new kid on the block, De Wolf became an irritation to the Amsterdam bankers. When he met Gouverneur Morris (1752-1816) in early 1790, De Wolf already had won many investment tombstones. Morris came to Europe with a long list of to-dos: purchase a watch for George Washington; improve relations with Britain; convince the European lenders that American debt was no junk; beg the Spanish, Dutch and especially the French governments and banks to be patient for the repayment of their loans; convince the Amsterdam bankers to grant new loans; spur on the French government to respect its commitments regarding the imports of American tobacco; sell millions of acres of land to European investors; purchase European goods, and provide funding to other American operations in Europe and to some Americans travelling in Europe. For a lesser man than Morris, this was a mission impossible, yet Morris extended this list to encompass at least two further ambitions: to play a significant role in politics and to become rich.

He had no official authority and his duties came with no job title, yet Morris felt perfectly at ease in this ambiguous situation; he had received a very good education in the law at King’s College (now Columbia University), had played a significant role in drafting the U.S. Constitution, and had learned finance and banking from Robert Morris (no relation) during their service in George Washington’s army. Officially he was a partner in the firm of Constable, Morris and Co., merchants, bankers and real estate speculators ruined by the American Revolution and always short of cash.

Morris was the right man in the right place. He felt perfectly at ease in the intellectually sophisticated, libertine French high society with numerous problems of its own including financial distress, crop failures, famine, the final days of absolute monarchy and a revolution in the making. Morris had a good command of French and German, and he could also understand and read Dutch/Flemish. He was smart, cultivated and charming with a great sense of humor–a quality De Wolf lacked completely–and combined good political insight with good business skills. His two physical impairments (see sidebar, Note 1) didn’t prevent him from fully enjoying the intellectual and sensual rewards of his relationships with many aristocratic women all over Europe. Politically he believed in the political role to be played by the elite/aristocracy to mitigate the risks of a dictatorship by the majority. The excesses of the French Revolution would soon prove him right, or so he thought.

Morris and De Wolf met for the first time in January 1790 in Antwerp over dinner. When De Wolf was informed that Morris was travelling to Amsterdam to meet Nicolaas van Staphorst (image, left), the banker and early supporter of the American revolution, his interest was immediately aroused. Normally a very prudent, very analytical, conservative banker, De Wolf became very forceful when he saw an opportunity to win business from the Dutch.

Morris and De Wolf met for the first time in January 1790 in Antwerp over dinner. When De Wolf was informed that Morris was travelling to Amsterdam to meet Nicolaas van Staphorst (image, left), the banker and early supporter of the American revolution, his interest was immediately aroused. Normally a very prudent, very analytical, conservative banker, De Wolf became very forceful when he saw an opportunity to win business from the Dutch.

Morris proposed a transaction/loan of USD130,000 for the U.S. government. De Wolf confirmed his agreement on February 21, 1790. Morris was still a guest in the house of Nicolaas van Staphorst. We know at that time that all Dutch bankers had already turned down his request for new loans. On the other hand, the negotiations regarding the worldwide trade of American tobacco had been very successful. Morris would receive a generous commission on a London account. The Amsterdam bankers were curious to see whether De Wolf would be foolish enough to actually commit real money to Morris’s projects.

The Amsterdam bankers would experience a sort of preemptive schadenfreude when De Wolf came to realize the situation he was in. De Wolf had told his Antwerp partners that the deal with Morris was well structured. Under no circumstances would he allow disbursements before the certificates, signed by the U.S. Treasury, and the documentation approved by a reputable New York lawyer, had been returned to Antwerp.

That would of course take months and Morris had no time to lose. He needed funding for his business projects and his expensive lifestyle. So he proposed a complicated alternative solution that, in reality, didn’t meet any of De Wolf’s conditions. Moreover, De Wolf had underwritten the deal with two partners–the Jonkers de Bosschaert and van der Borcht. Their understanding was that they were providing new money to the U.S. Government–a rather silly idea and a banker with De Wolf’s experience knew that. In his letters to Morris, he specified explicitly that it concerned “liquidated debt” or debt on which the United States had defaulted.

De Wolf concurred with Morris’s complicated “solution”: The first appointed Dutch envoy to the United States, Jonker van Brienen, would take the loan documentation to the United States and, as soon as his ship set sail from Texel, van Berkel, De Wolf’s correspondent in Amsterdam, would send a messenger to Antwerp confirming that “the loan documentation is in good hands and almost in the United States.” This was complicated and utterly irrelevant. De Wolf violated one of the most important rules of Chase’s Credit Policy Guide: It is a general rule in banking that deviations from normal procedures are very difficult to correct once the money is out. In fact, it would take more than 10 years to correct this problem. Eventually it was Daniel Ludlow, the first President of the Manhattan Company, who regularized this deal. But again, De Wolf knew perfectly well from the start that this was no new money, but he didn’t tell that to his two partners.

What really happened to the money?

De Wolf provided his clients with detailed account statements. The first one in Morris’ name, attached to De Wolf’s letter of February 11,1792, provides some answers. The Morris account was credited for the amount of the American debt that he sold to De Wolf. The latter paid more than the market price, about 65 cents/dollar.

De Wolf provided his clients with detailed account statements. The first one in Morris’ name, attached to De Wolf’s letter of February 11,1792, provides some answers. The Morris account was credited for the amount of the American debt that he sold to De Wolf. The latter paid more than the market price, about 65 cents/dollar. Moreover, Gouverneur received a “cachet” or secret commission. On the debit side, the money was disbursed in several currencies, large amounts in Sterling and smaller amounts in Guilders or Dollars. Sometimes the beneficiaries were historic figures like the American naval hero John Paul Jones (left photo, then a rear admiral in the Imperial Russian Navy. William Constable (of Macomb's Purchase fame, right photo ) also received some money, as well as German and Danish traders known for their American sympathies.

Moreover, Gouverneur received a “cachet” or secret commission. On the debit side, the money was disbursed in several currencies, large amounts in Sterling and smaller amounts in Guilders or Dollars. Sometimes the beneficiaries were historic figures like the American naval hero John Paul Jones (left photo, then a rear admiral in the Imperial Russian Navy. William Constable (of Macomb's Purchase fame, right photo ) also received some money, as well as German and Danish traders known for their American sympathies.

For the large amounts in Sterling, we don’t have the names of the final beneficiaries. All these amounts, however, were drawn on letters of exchange in Sterling on De Wolf’s correspondents in Amsterdam. The beneficiaries of these drafts are always Phijn, Ellices and Iglis, a firm of American loyalists in London. Morris, when in London, resided in their house. Based on the information in Morris’s “waste book” and his accounts held by the Library of Congress, we can conclude that De Wolf’s money enabled Morris to fund the start of his European business dealings, specifically in liquidated debt, of which there was plenty circulating in Europe, tobacco, cotton, wheat and land.

De Wolf and his partners on a different footing

With USD130,000 at least temporarily unaccounted for,  one would expect that Charles De Wolf would show great reluctance to enter into new dealings with Gouverneur Morris, but the opposite was true. De Wolf was now pushing for the real thing, a loan of 3,000,000 Brabantine Guilders (about USD1,950,000). For comparison purposes, at the time, the total U.S. federal budget was about USD2,400,000. New loans were the responsibility of William Short (1756-1836) the American envoy to Paris. But, so long as the American public finances had not been put in order, no sensible banker would lend new money to the United States. Congress had not yet the power to levy taxes. Yet for the American government, an outsider like De Wolf could enhance their financial standing in Europe and help them to gain

one would expect that Charles De Wolf would show great reluctance to enter into new dealings with Gouverneur Morris, but the opposite was true. De Wolf was now pushing for the real thing, a loan of 3,000,000 Brabantine Guilders (about USD1,950,000). For comparison purposes, at the time, the total U.S. federal budget was about USD2,400,000. New loans were the responsibility of William Short (1756-1836) the American envoy to Paris. But, so long as the American public finances had not been put in order, no sensible banker would lend new money to the United States. Congress had not yet the power to levy taxes. Yet for the American government, an outsider like De Wolf could enhance their financial standing in Europe and help them to gain  more time to organize the finances of the federal government. Short contacted Alexander Hamilton (portrait by John Trumbull, left, from 1792) in his letter of November 8,1791. The papers of Alexander Hamilton include numerous references to Charles De Wolf. Hamilton was clearly interested.

more time to organize the finances of the federal government. Short contacted Alexander Hamilton (portrait by John Trumbull, left, from 1792) in his letter of November 8,1791. The papers of Alexander Hamilton include numerous references to Charles De Wolf. Hamilton was clearly interested.

De Wolf‘s false perception was that Morris was his sponsor for serious business with the United States and that Short was the gatekeeper. In reality, there was little Morris could do, and both Short and Hamilton understood De Wolf’s offer perfectly, with its advantages and its risks. The main problem for them was that De Wolf could only underwrite on a best effort’s basis, and with the condition of the new country's credit standing, that could be a major problem. The great advantage of the Amsterdam bankers was that, in the past, they had made a firm commitment for the full amount, placed or not. If De Wolf’s deal failed, the USA‘s credit standing would be worse off than before.

On the other hand, there was this unique opportunity to execute a payment to the French lenders whose pressure could no longer be ignored. So Short made a very reasonable counterproposal to reduce the amount to 1,000,000 Brabantine Guilders (USD650,000). De Wolf took this as a personal insult: He would provide the full amount or nothing. Without any signed agreement, De Wolf started to accept money for the American issue, the prospectus was published and the bonds were also printed awaiting Short’s signature–all this without a formal mandate.

Late in 1791, De Wolf and his lawyer travelled to Paris to convince Short to sign the documentation. Short had indeed been mandated by his government with the understanding that the 4 percent fee–at the lower end of the customary 4-8 percent–would only be due on the amount actually placed. De Wolf, still under the illusion that it was Morris who enabled this deal to get approved, confirmed on November 18,1791 that Morris would receive his promised 50 percent share of the upfront fee of “only” 4 percent.

A few months later, Morris’s account was credited with 44,000 Guilder (USD 28,600), so we can deduce that 2,200,000 Guilders had actually been placed. Everybody except De Wolf considered this a major success. He begged Morris and Short for an extension to the subscription period, in order to place the full three million. But the transaction had the effect the Americans had been hoping for; the Amsterdam bankers were now willing to negotiate a larger deal. They offered somewhat better terms to make sure that De Wolf didn’t get more time from the U.S. government. For De Wolf, the good news was that the first interest maturity on his issue would be paid by Amsterdam. For all further payments, however, there would be major problems.

De Wolf gets stuck in tunnel vision, but Gouverneur Morris is shining a light to guide him

Based on his letters, we have to conclude that De Wolf got more and more obsessed by the United States in general and Gouverneur Morris in particular. In his letters he describes “his vision” for a “honorable financial future for the United States” to Morris. De Wolf, a very fine analyst of the risks, rarely drew the obvious conclusion when Morris and the USA were involved. Before concluding, he always referred to Morris, and over time he became his glove puppet. He would always follow Morris’s advice/wishes and that would almost lead to his ruin. Morris’s counsel was always highly biased in favor of an inner circle of friends and people to whom he felt indebted. So, De Wolf was playing the role of one of the rich idiots Morris regularly tapped for money. Why could a banker with De Wolf’s experience and abilities not see the obvious?

First, De Wolf was suffering more and more from chronic health problems. When we googled the long list of symptoms mentioned in his letters to Morris, as well as his spectacular recovery when he was ‘cured’ for two months at the Spa of Burtschneid, Germany, the diagnosis is “lack of sulfur”. The waters of Burtschneid, near Aachen, are indeed rich in sulfur. On his return, De Wolf felt so good that he married the girl next door, Joanna Antonia Ergo (1772-1856). She was a middle-class girl, the daughter of a diamond polisher. She was well educated–the exception for middle-class girls in those days. She was smart, trilingual and a much better judge of character than her husband. (Morris was immediately interested in her when they first met, and it is very possible that they had an affair.)

Unfortunately, De Wolf's recovery was only temporary. Geopolitics also changed his life. The French revolutionaries, in their desire to liberate all oppressed people of Europe–preferably after killing them first–had extended the borders of France to the Rhine and to Italy. De Wolf and his Dutch competitors were now French citizens. As a financier of the army of the First Coalition against France, De Wolf didn’t like the French and they didn’t like him. He was taken hostage on at least three occasions.

His clients had also gone: The high nobility was fighting the French in the Prussian, Russian or Austrian armies or simply living in exile. With France at war with most European powers, De Wolf was not allowed to raise money for France’s enemies. He could lend to the French Republic/First Empire, but he only did so when he was forced to. He expanded beyond classical banking and committed money to venture capital, such as for the production of sugar from sugar beet. This new source of sugar, replacing cane sugar, became highly profitable and enabled De Wolf to pay for his American follies.

Yet, in relative terms, American risk had improved. Moreover, the United States was not blacklisted by France. Though very slowly, American public finances became more or less organized. Interest payments were still problematic but not totally impossible. The U.S. Funding Act of 1790 (see Note 2 in sidebar), through which the federal government assumed and retired the debt of the individual colonies, provides some insight into American intentions.

De Wolf’s interest in new American business would once again be triggered by an external event.Not unexpectedly, the triggering event came from Amsterdam. A baker's dozen of Dutch bankers had bought nearly eight million acres of land in New York State and sold them to the Holland Land Company, making a profit of 1,000,000 Guilders in a very short period of time. De Wolf, who had declined two offers in the past brokered by Morris to buy American land, completely changed his position. With his “good friend” Morris now named U.S. envoy to Paris, De Wolf naively expected that Morris would give him the golden lead to a very profitable real estate transaction.

In all fairness to Morris, he gave De Wolf the same advice that he gave to all investors: “Send someone competent to survey these lands. Better still, have a first look yourself." Some followed this advice, including Talleyrand, Le Couteulx, Sir Francis Baring, Dupont de Nemours, David Parish and the Amsterdam bankers. Others didn’t, like Viscount de Ségur, who bought an estate from Robert Morris that had already been sold twice. De Wolf also would never bother to send surveyors to the United Stataes. He completely relied on Gouverneur Morris, a serious and costly mistake.

Gouverneur, who understood De Wolf’s modus operandi, now set a trap. He proposed a meeting with James Le Ray de Chaumont (1760-1840) (photo left), probably his best friend in France. De Chaumont had been educated by Benjamin Franklin (1702-1790) during his stay in France, benefitting from the hospitality of the Le Ray family. The Le Rays were rich and liberals. When the Jacobins–the most extreme faction of the French revolutionaries–seized absolute power, the French Revolution turned into an orgy of blood. The clergy, the nobility and many others were arbitrarily prosecuted and many were executed. Being liberal was not good enough, and the assets of the Le Ray family were nationalized.

Gouverneur, who understood De Wolf’s modus operandi, now set a trap. He proposed a meeting with James Le Ray de Chaumont (1760-1840) (photo left), probably his best friend in France. De Chaumont had been educated by Benjamin Franklin (1702-1790) during his stay in France, benefitting from the hospitality of the Le Ray family. The Le Rays were rich and liberals. When the Jacobins–the most extreme faction of the French revolutionaries–seized absolute power, the French Revolution turned into an orgy of blood. The clergy, the nobility and many others were arbitrarily prosecuted and many were executed. Being liberal was not good enough, and the assets of the Le Ray family were nationalized.

Le Ray de Chaumont escaped to the United States, married a rich American heiress and intended to replicate his life as lord of the manor in upstate New York.

Alas, his ambitions were not matched by genuine business skills, but he was a smooth talker and a landowner in the same area Morris offered to De Wolf. Moreover, he committed to participate in De Wolf’s deal. This was what De Wolf in his naïve mindset wanted to hear. Constable came over to London and De Wolf purchased 440,000 acres  of land in northern New York, currently part of Jefferson and Lewis counties. Morris got his usual commission. De Wolf invested his own money, convinced as he was that he would be able to sell with a considerable profit in a very short period of time–a rather silly idea. (See Note 3)

of land in northern New York, currently part of Jefferson and Lewis counties. Morris got his usual commission. De Wolf invested his own money, convinced as he was that he would be able to sell with a considerable profit in a very short period of time–a rather silly idea. (See Note 3)

In fact, selling the entire 440,000 acres would take more than 50 years. The largest buyer was James Le Ray de Chaumont, who bought 220,000 acres but had no money to pay for it, so he received generous credit terms. De Wolf urgently needed to restore his own liquidity. Hence he launched a public issue in the name of the Antwerp Land Company. The prospectus described the 440,000 acres as an enhanced version of the Garden of Eden. Being an Antwerpian, De Wolf was convinced that his land was the ideal location to build a port along the Saint Lawrence River–just like Antwerp along the River Scheldt.

De Wolf’s objectives were to restore his liquidity, lock in a profit and fund three years of interest payments. The sum of all this amounted to 1,200,000 Brabantine Guilder (USD780,000). Unfortunately, he could only place 800,000 Guilders (USD 520,000). He got his money back and made a profit, but for future interest payments there was no money. He clearly transferred the risks to his clients. Moreover, he remained the legal owner of the land. Morris, for the first and only time, participated for 14,398 Brabantine Guilders, the balance in his favor in De Wolf’s books.

During his lifetime De Wolf relied entirely on Morris, who, on the occasion of his last visit to Antwerp in 1798, had received the original titles of property and power of attorney to sell the land. He would actually sell land to General Lewis Morris, probably his stepbrother, and to his good friend David Parish (1778-1826), also from Antwerp. But during De Wolf’s lifetime, the money never got to Antwerp.

Charles De Wolf died in 1806. Being a Roman Catholic and a pillar of the Church had its advantages in those days. His last will and testament stipulated that 2,000 masses had to be celebrated for the redemption of his sins. His young widow, Joanna Antonia Ergo, became his sole heir, including inheriting the bank. The old man gone, she was immediately sued by the investors for more equitable treatment. They came to an arrangement on October 10, 1806. She remained in charge of the American problem, but her decisions had to be approved by three newly appointed supervisors. Of course, they were all older men who in less than three years had all joined De Wolf in the eternal hunting grounds in the sky. In short, she quickly found herself completely in charge.

Is all well that ends well?

Joanna spent time and money to find a solution for the American real estate. Initially she followed her husband’s example and turned to Gouverneur for help and advice. She turned out to be a better judge of character than her late husband. First, she played the role of a lady in distress because she knew that Gouverneur had helped many such ladies. When that didn’t motivate Gouverneur Morris to transfer the proceeds of 44,000 acres sold to General Lewis Morris, the tone of her letters became more aggressive. In her last letter, dated September 28, 1809, she accused Gouverneur: “You are responsible, you sold the acres to my husband.” A significant detail was that the letter bore no title in the address, effectively her way of saying to Gouverneur “You, sir, are not a gentleman.” In all fairness to Gouverneur, however, he must have returned the original titles of property at some moment in time, but when and how we don’t know. He died in 1816. Although Le Ray de Chaumont stepped in as a self-declared agent of the Antwerp Land Company, events were soon to be decided by lawyers.

Eventually the acres were sold for a profit. James Le Ray de Chaumont was declared bankrupt in the State of New York. In 1815 Napoleon was beaten at Waterloo. The Le Rays were reinstated in the possession of their French assets, estates, castles, lands, forests, lakes and homes. Joanna Ergo then launched a claim on these French assets in a combined operation involving N.Y., French and Antwerp lawyers–a very complicated legal case involving three different jurisdictions.

Judging by the results, the legal systems worked better than today. The French Commercial Court accepted the claim regarding the sold and unpaid acres. Moreover, Le Ray de Chaumont was also declared bankrupt in France. Three liquidators were appointed by the Court to sell his French assets, and they took their time. The Bank De Wolf was extremely lucky because of the exchange rates applied in their calculations and especially because of the capitalization of the interest. The final payment was made in 1852 and covered more than the total purchase price paid by De Wolf in 1793, corrected for inflation. So, the other 220,000 acres were pure profit.

Concluding remarks

Much more research would be required to further explore important facts and figures. There is valuable information in the Amsterdam City Archives that would give the full picture of De Wolf’s as well as Gouverneur Morris’s financial transactions. More in-depth research into the years (1795-1798) that Morris stayed in Altona, Hamburg, after being recalled as U.S. envoy, could also provide new information. Morris stayed in the Hamburg home of George Parish, whose son, David Parish was in charge of the family’s Antwerp business.

It was probably David Parish (left) who brokered the first contacts between Morris and De Wolf. David Parish had no moral objections to work for and with the French. In 1806, Talleyrand, the French Foreign Minister, provided him with a golden lead to look into the problems Spain encountered with silver piasters. Parish followed the advice, found a solution and transferred the business from Antwerp to Philadelphia. He was one of the first individuals in the United States with assets of more than USD1,000,000. Parish also bought 44,000 acres from Gouverneur Morris in the Ogdensburg area. But hubris led to his ruin, and he committed suicide in Vienna.

It was probably David Parish (left) who brokered the first contacts between Morris and De Wolf. David Parish had no moral objections to work for and with the French. In 1806, Talleyrand, the French Foreign Minister, provided him with a golden lead to look into the problems Spain encountered with silver piasters. Parish followed the advice, found a solution and transferred the business from Antwerp to Philadelphia. He was one of the first individuals in the United States with assets of more than USD1,000,000. Parish also bought 44,000 acres from Gouverneur Morris in the Ogdensburg area. But hubris led to his ruin, and he committed suicide in Vienna.

Our research into Morris’s dealings with De Wolf and Joanna Ergo is based on the information available to us–basically letters, contracts, account statements and prospectuses. That evidence is of course one-sided and circumstantial. Gouverneur Morris was the mastermind at the center of at least five banks, enabling him to get money out of France on behalf of the aristocracy for a commission of 12.50 percent. Morris also was able to get the entire art collection of the Duke of Orleans out of France and moved to England.

In 1798 Gouverneur Morris estimated his personal fortune at USD124,000, thus achieving his ambition to become rich.

* * *

For us, Marc Smits and Josse Borremans, our quest ends here. We toyed with the idea of funding a scholarship at Antwerp University to perform more in-depth research, but that turned out to be too expensive for the little Antwerp Chapter of the Chase Alumni.

Extended bibliography can be provided on request.

Notes

NOTE 1 RE: Gouverneur Morris's Disabilities

From Jennifer Reiss in Penn Today:

Founding Father, Disabled American

NOTE 2 (from Wikipedia)

The Funding Act of 1790, the full title of which is An Act making provision for the [payment of the] Debt of the United States, was passed on August 4, 1790, by the United States Congress as part of the Compromise of 1790, to address the issue of funding (debt service, repayment, and retirement) of the domestic debt incurred by the state governments, first as Thirteen Colonies, then as states in rebellion, in independence, in Confederation, and finally as members of a single federal Union. By the Act the newly-inaugurated federal government under the U.S. Constitution assumed and thereby retired the debts of each of the individual colonies in rebellion and the bonded debts of the States in Confederation, which each state had individually and independently issued on its own "full faith and credit" when each of them was, in effect, an independent nation.

Through the new Department of the Treasury, the U.S. government issued U.S. Treasury Securities backed by the "full faith and credit" of the United States and offered them to the bondholders of the former States' and Confederation's bonded debts at par—that is, at 100% of the state bonds' face value (full assumption) and at rates of interest (and all other terms) that were as specified on the bonds when they were issued by the states and Confederation.

When that was done, "full assumption" of state debts by the federal government had thereby occurred through the issue of federal securities and, for the states of the new Union, the full and complete retirement of their bonded obligations incurred in the Revolution and the Confederation.

NOTE 3 (Josse Borremans writes):

From the account statement of Gouverneur Morris in the books of Charles De Wolf, it appears that the latter paid USD130,000 (200,000 Brabantine Guilders) to purchase liquidated debt from Gouverneur, but the nominal amount was not mentioned. From the context we can conclude that he bought at a discount before the restructuring of the U.S. debt in August 1790.

De Wolf’s associates De Bosschaert and Van der Borcht, both lawyers, had the strange idea that their USD130,000 was what they called “a primitive right” that could not be affected by the restructuring of the U.S. debt. The legal concept of “primitive right” in the legal system of Brabant meant that the contractual obligations of the parties could not be changed then by mutual consent. Neither could these rights be altered by the U.S. Congress or by the U.S. Treasury. Rather strange ideas from the American perspective! Morris asked Constable to come to London to explain the restructuring of the U.S. debt to De Wolf et al. That was done, but De Bosschaert and Van der Borcht din’t change their position.

In reality De Bosschaert and Van der Borcht stuck to the agreement confirmed in De Wolf’s letter of February 21 (in French) to Morris, then a guest in the house of Nicolaas van Staphorst in Amsterdam. De Wolf and his associates demanded and Morris accepted that “their liquidated debt” would be evidenced by new certificates signed by the U.S. Treasury. The first Dutch envoy to the States took these documents with him to America, where they were probably remitted to William Constable to have them signed by the Treasury.

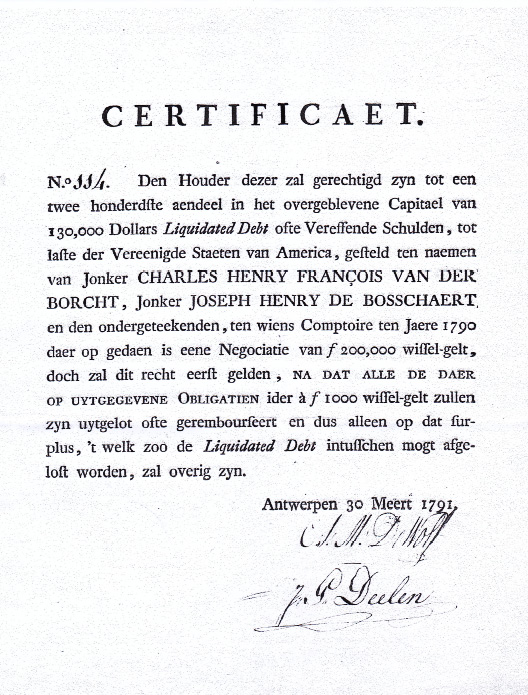

To complicate things further, there are indeed certificates that were returned to Antwerp several times, but each time there were strange “mistakes” in the names of the beneficiaries of the certificates. These names should have been Joseph Henry De Bosschaert, Henry van der Borcht and Charles John Michael De Wolf. Each time a package of certificates got through to Antwerp, one or several of the names were spelled incorrectly, so De Wolf returned them. But De Bosschaert and Van der Borcht compelled De Wolf to issue parallel certificates payable by De Wolf if and when the United States repaid their liquidated debt. By so doing, De Wolf had to invent a derivative instrument. He also called that instrument "certificate", but he alone signed them. How he repaid De Bosschaert and Van der Borcht we don’t know. My personal opinion is that he didn’t repay them, because I bought an original of these De Wolf certificates at auction in 2018 (see below).

I am inclined to think that William Constable and Robert Morris–Gouverneur Morris’ principals–were unable to comply with the conditions of the transaction. Gouverneur Morris might not have been aware of what happened in the United States because he was informed by Constable in the winter of 1791. Constable eventually travelled to Europe to explain the situation of American liquidated debt to De Wolf et al. What happened in reality I don’t know. When De Wolf bought the 440,000 acres from Robert Morris and William Constable, however, part of the purchase was paid in American liquidated debt held by Constable or said to be held. So it could be that the certificates supposedly signed by the U.S.Treasury never existed and that it was basically a “creative mechanism” corrected on the occasion of the real estate transaction. Clarifying these complications would require months of research in American archives.

The owner of this document is entitled to two hundredths of the remainder of the Capital of 130,000 Dollars “Liquidated Debt”, or the liquidated debt of the United States of America, adjudicated to Jonker Charles Henry François van der Borcht, Jonker Joseph Henry de Bosschaert, and the undersigned, who have been paid on their account in the year 1790, an amount of f 200,000 change, but this right will be in force only after all the issued bonds each of f 1,000 denomination have been drawn by lot, or reimbursed, thus only of such surplus remaining after the “Liquidated Debt” might have been repaid in the meantime.

Signed: Antwerp, March 30, 1791

A.M. De Wolf

Jhr. P. Deelen

(translated by Hans van den Houten)