ROBERT SHIPPEE thanks ROBERT STRONG

PHIL SORACE thanks JERRY SULLIVAN, JIM BRENNAN,

PETE BAILEY, TONY TERRACCIANO, MIKE CASSIDY,

RON KEENAN, ALDEN SMALL, TIM MCGINNIS,

BARBARA O'NEAL, JACK WOODS, PALMER TURNHEIM,

WOLF SCHOELLKOPF and TOM O'REILLY

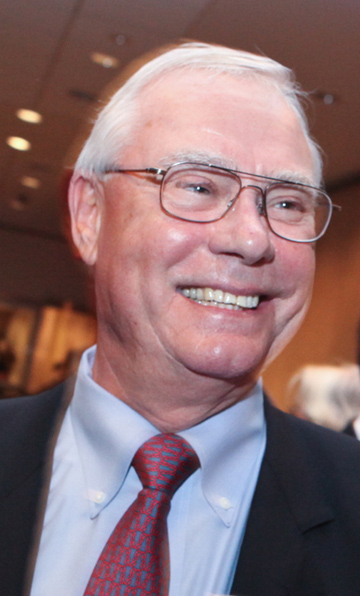

Executive. There was Alden Small, who taught me the business end of real banking and Tim McGinnis (photo left), who cultivated an appreciation for the art of customer relationships and self-inspection and awareness; and of course, Barbara O’Neal, who showed me what true teamwork and partnering was all about. There was Jack Woods, who gave me the opportunity to travel the world exploring the depth of lending done rightly and wrongly; of policies that worked or failed; of monitoring systems that were valid or not; and, not the least, mentoring and instructing new would-be bankers and financial analysts. I owe Palmer Turnheim, who showed me there was always "another way to skin a cat” and to Wolf Schoellkopf, who opened the world of global money markets and products and the art and science of asset/liability management. So, for me there was no one mentor but, a bank full - The Chase Manhattan Bank, NA. These were just a few of the most impactful people in my career. There were so many more in the International and Institutional and Treasury departments who influenced my thinking and performance.

Executive. There was Alden Small, who taught me the business end of real banking and Tim McGinnis (photo left), who cultivated an appreciation for the art of customer relationships and self-inspection and awareness; and of course, Barbara O’Neal, who showed me what true teamwork and partnering was all about. There was Jack Woods, who gave me the opportunity to travel the world exploring the depth of lending done rightly and wrongly; of policies that worked or failed; of monitoring systems that were valid or not; and, not the least, mentoring and instructing new would-be bankers and financial analysts. I owe Palmer Turnheim, who showed me there was always "another way to skin a cat” and to Wolf Schoellkopf, who opened the world of global money markets and products and the art and science of asset/liability management. So, for me there was no one mentor but, a bank full - The Chase Manhattan Bank, NA. These were just a few of the most impactful people in my career. There were so many more in the International and Institutional and Treasury departments who influenced my thinking and performance. EDITH ORENSTEIN thanks DAVID M. MORRIS

The week of November 22, 2021: Top row–David M. Morris (joining from London, U.K. where he was vacationing with his wife, Mary Elaine Morris, Edith Orenstein, Peggy Capomaggi, Bottom row–Miriam Haimes, Mark Riley

The Accounting Policies and Procedures (“AP&P”) division of Corporate Controllers at The Chase Manhattan Bank, N.A. in the late 1980s/early 1990s was a fantastic base from which many talented people were nurtured and grew into significant roles throughout the bank. I would like to pay tribute to then-AP&P Director, David M. Morris, a Senior Vice President at The Chase Manhattan Bank, N.A., for his outstanding leadership of the division, including his wise choice and development of the VPs reporting to him who led the various specialized groups in AP&P (groups that specialized in credit and lending, derivatives and FX, emerging accounting and reporting issues, and more).

I benefited greatly not only from David’s leadership and mentorship, but also from the leadership of the VPs whom he cultivated in turn as managers of the five subgroups in the division (a total of about 30 staff in AP&P’s heyday). Although there are many names I may remember and many I am afraid I will forget, some of the top names that come to mind among the VPs that David nurtured who were excellent and supportive managers – and went on to leadership roles in the bank (including Bob Krug, Mark Reilly and Lisa Wegweiser) or at other respected financial institutions such as Morgan Stanley (Peggy Capomaggi), TD Bank (Miriam Haimes) and AIG (Mary Molloy).

And it is just this aspect of David developing managers and staff who reported to him, so they could grow into roles they personally desired – even if it meant leaving the AP&P division or ultimately the bank – that I would like to focus on.

I will always be grateful for the wide range of interesting and highly dedicated people David introduced me to through assigning me work outside the division, even outside the bank–e.g., projects interacting with staff of the American Bankers Association, New York Clearinghouse Association, Financial Executives International and the American Institute of CPAs– which helped grow my understanding of and interest in industry-wide advocacy organizations.

I am certain that my experience at Chase played a major role in my reaching the next steps in my career. This included opportunities that David provided in AP&P to work on projects such as industry-wide comment letters on proposed regulations, helping proofread his many speeches and presentations (given his leadership role of the ABA Accounting Committee, AICPA Banking Committee, and various Bank Administration Institute (BAI) programs); and in supporting the work that David led, in turn supporting industry leadership roles held by then-CFO Mike Esposito, and then-Corporate Controller Les Stephens. It was really an exciting time to work for Chase! I also benefitted from David’s mentorship, and in turn through the support of the group managers who reported to him, by being given the opportunity to support ad hoc working groups within the bank, such as the cross-functional task force the FDIC Improvement Act of 1991 (“FDICIA”). Another great memory is being given the “opportunity” to join a team pulling an all-nighter at the printer (then, RR Donnelly in lower Manhattan), as we proofread successive drafts for a particular filing scheduled for the next day. (Isn’t it true that some of our best memories are from some of the hardest projects?)

In all of this work, David encouraged positivity and a cohesive staff, emphasizing quality, teamwork and the Chase mission, vision and values. (In fact, I remember it was during this time in AP&P that the bank also rolled out a Total Quality Management or TQM program, which was very much tied to Chase’s mission and vision, and I am grateful to have participated as part of the “Alpha Delta” team!)

Most exceptional of all in terms of David’s mentorship, was the fact that I was able to express my desire to one day work in a function such as Government Relations or Corporate Philanthropy at Chase–and the fact that my career interest was outside AP&P and Corporate Controllers. While other leaders may have taken a negative view that holding interest in growing into another part of the bank, or a role outside the bank, was “disloyal,” David did not have that view at all; in fact, he set out to introduce me to people who worked in those roles at Chase so I could speak with them informally about my career interests. And, when I said I was considering a Congressional staff-related internship with The Conference Board, he agreed to support my application. In addition, when I asked if I could take a day off to attend Congressional hearings and speak with a staff person of a Congressional committee in Washington, DC about my career interests, David had no problem with that whatsoever and encouraged me to explore my dreams in terms of potential government-relations type careers, as well as my involvement recruiting other Chase teammates to participate in corporate volunteer projects (including the March of Dimes team walk) – but all-the-while emphasizing directly (and through his managers who I reported to directly) to also not lose sight of my “day-job” in AP&P.

I am certain that David’s mentorship led directly to my later careers, working for the U.S. Securities and Exchange Commission (SEC) and then for Financial Executives International (FEI). In each of those jobs, I would occasionally interact with industry groups that met with the SEC or FEI, and it was always a pleasure to see David when he participated in those groups.

I’d like to extend my thanks to David and all the group VPs who managed me directly under his leadership for supporting not only my career but also supporting me as a person, even before the term “work-life balance” and the focus on employee’s holistic health came into vogue. They were all exceptional and ahead of their time, and most of all, great mentors and great human beings.

GARY OLSON thanks JOHN PHILPOT and GEORGE PERRY also BOB ABERLIN, TIM MCGINNIS, DON CHAFEE

John Philpot (photo left) and George Perry were senior credit officers and just unbelievable mentors to us young act’s in the 1970s. If I could ever meet these two men again (probably will have to be in heaven), I would like to thank them so much for being so nice and caring to a young new Chase guy in the International Credit Department–a first generation college grad with little or no experience in finance who was trying hard to fit in. Though they were many many levels above me (John a senior vice president, chief international department credit officer (what a great guy) and George, executive vice president and chief credit officer of Chase (just as great a man), they were like fathers and taught me so much. Thank you guys. I have not forgotten. PS Thank you Bob Aberlin and Tim McGinnis and Don Chafee: You were also the best mentors to a young guy just starting out. Really appreciate it.

John Philpot (photo left) and George Perry were senior credit officers and just unbelievable mentors to us young act’s in the 1970s. If I could ever meet these two men again (probably will have to be in heaven), I would like to thank them so much for being so nice and caring to a young new Chase guy in the International Credit Department–a first generation college grad with little or no experience in finance who was trying hard to fit in. Though they were many many levels above me (John a senior vice president, chief international department credit officer (what a great guy) and George, executive vice president and chief credit officer of Chase (just as great a man), they were like fathers and taught me so much. Thank you guys. I have not forgotten. PS Thank you Bob Aberlin and Tim McGinnis and Don Chafee: You were also the best mentors to a young guy just starting out. Really appreciate it.

DICK HAY thanks DAVE BOYCE and STAN BURNS

LAURENCE DeVAN thanks PETER HOLZER, BILL HIGGINS and JACK HOOPER

Jack Hooper was Vice Chairman and Senior Credit Officer of CMB with whom I had an unusual number of opportunities to interact as the junior banker on the GM relationship, due to its size. Jack is one of a handful of people I have admired most in my business career.

Jack Hooper was Vice Chairman and Senior Credit Officer of CMB with whom I had an unusual number of opportunities to interact as the junior banker on the GM relationship, due to its size. Jack is one of a handful of people I have admired most in my business career.

Chase career before I joined State Street Bank & Trust in 1991in Boston and

the NYSE in 2003.

I joined Chase September 1, 1976, four days before being discharged from the Marine Corps, which included 28 months in Vietnam and two years deployed to the Caribbean and Mediteranean aboard ships.

I quickly learned not to call 1CMP 60th Floor the "Mess Hall", but it was the more subtle cultural aspects that Frank guided me thru...so thanks, Frank!

(left, Marsh Carter)

ED MORAN thanks KAYE JONES, MARTY LOGAN, TOM HILL, PAUL WALKER, GREG BRENNAN

I had a number of mentors during my career at Chaseand all of them were on the credit side of the business. Kaye Jones, Marty Logan, Tom Hill, Paul Walker, Greg Brennan. All of them were unselfish in giving guidance and ideas on how to do the business better. Tom Hill once told me, “Treat the bank’s money as you would your own.” All were fiercely loyal to the basic Chase ideals, sometimes at the risk of their own careers in what was increasingly a highly political environment. (left, Ed Moran; right, Paul Walker)

(photo of Aspbury)

(photo of Aspbury)JOHN HEHIR thanks BOB BARNES, JACK GATES, FRANCIS MASON, PETER NICE, ULISES GIBERGA, FRANK REILLY, MIKE URKOWITZ, LIZ FLYNN, DON BOUDREAU and YORAM KINBERG

In my 33 years with Chase, I was fortunate to work for some great leaders who influenced me significantly. These included the late Bob Barnes, Jack Gates, Francis Mason and Peter Nice as well as the surviving Ulises Giberga (photo, right), Frank Reilly, Mike Urkowitz and Liz Flynn. They all contributed very positively to my career in their own unique, additive and distinctive way. For their tolerance and patience which I tested frequently, I am grateful.

significantly. These included the late Bob Barnes, Jack Gates, Francis Mason and Peter Nice as well as the surviving Ulises Giberga (photo, right), Frank Reilly, Mike Urkowitz and Liz Flynn. They all contributed very positively to my career in their own unique, additive and distinctive way. For their tolerance and patience which I tested frequently, I am grateful.

I would be remiss, however, if I didn’t mention Don Boudreau (photo, left) whom I knew for over 30 years. I was fortunate to work for him for eight of my last nine years at the bank. Don was a demanding boss who expected total honesty, candidness and accuracy. But he was one who stood up for his subordinates. Even though I felt his wrath more than once, I was always treated evenhandedly and with respect.

I would be remiss, however, if I didn’t mention Don Boudreau (photo, left) whom I knew for over 30 years. I was fortunate to work for him for eight of my last nine years at the bank. Don was a demanding boss who expected total honesty, candidness and accuracy. But he was one who stood up for his subordinates. Even though I felt his wrath more than once, I was always treated evenhandedly and with respect.

Finally I should mention Yoram Kinberg. He taught me to never be hesitant to speak up and ask questions whenever I thought it appropriate and no matter what the forum. This didn’t make me very popular with some, but I think served the corporation well.

Photos: Below, left: John Hehir's retirement party in December 1998. L-R: Liz Flynn, Don Boudreau, John Hehir and Mrs. Hehir. Below right: Yoram Kinberg

Giving Thanks to Mentors, Part 3

►Dé Pham Lifvenborg thanks Liz Flynn and David Baggs, Carter Booth, Peter Lighte and

Ro Fallon

►Monica Altmann thanks Richard Guariglia

►Barbara Tsarnas thanks Steve Friedman

►Hugh Balloch thanks Peter Nice

►Gillian van Schaick thanks Bob Russo

►Sally Ballweg thanks Scott Blatterman & Ed Nelson

►Larry Bloom thanks Anthony J. Annucci

►Dave Farrell thanks Bob Dandrea

►Brahm Nirgunarthy thanks John Fabrizio

►Steve Wertheim thanks Tom Poplawski

►Bill Kaufmann thanks David Rockefeller

ANNETTE WHITTEMORE thanks JANE KLIVANS

(Photo left, from a wedding: L-R: Annette Whittemore, Shawn Alexander, Jane Klivans and Lisa Thomas. Lisa still works at the bank while Shawn and Annette are retired. Jane died in 2020.)

Jane Klivans was truly one in a million and a huge influence in my life, and in that of many of my colleagues in the investment business. Jane brought me from Buffalo to Bank One in Columbus almost 30 years ago, was my boss and mentor for 19 years and my friend since the time we met. There was no one as smart and as loyal. She always looked out for her employees, and taught us so much. Jane was one of those people who were larger than life! She always had a smile on her face; she was always so pleasant even when she was pushing an innovative idea that challenged norms at the time. She initiated products that revolutionized the firm’s securities business, which had been solely focused on trading until that time. Even in the past years after her retirement, the only thing that changed were names and addition of third-party funds and managers. Her smarts, persistence and creativity were admired enormously by all.

JERRY HANNON thanks AL GAMPER, ED FARLEY, JOHN DOWLING, JIMMY LEE and especially JOHN ZUTTER

Like others posting here, I (photo, left) have far more than one person to thank for my career at what has become JP Morgan Chase. I joined Manufacturers Hanover after active duty in the Navy and my first boss was Al Gamper, probably the best account officer within the bank, who taught me how to be important for your clients. I had an opportunity to work on the staff of Ed Farley, then the senior officer responsible for Midtown corporate banking branches; Ed reminded me of the feeling of being on the bridge of a ship when the commanding officer enters and the space suddenly feels cold and all of the officers' watches stop. "Terror" aside, Ed taught me precision and comprehensive awareness.

Like others posting here, I (photo, left) have far more than one person to thank for my career at what has become JP Morgan Chase. I joined Manufacturers Hanover after active duty in the Navy and my first boss was Al Gamper, probably the best account officer within the bank, who taught me how to be important for your clients. I had an opportunity to work on the staff of Ed Farley, then the senior officer responsible for Midtown corporate banking branches; Ed reminded me of the feeling of being on the bridge of a ship when the commanding officer enters and the space suddenly feels cold and all of the officers' watches stop. "Terror" aside, Ed taught me precision and comprehensive awareness.

Then I worked for John Dowling, who ran the MHT branch at 43rd and Fifth known as “The Glass House“. I was having a crisis of confidence and John, in his Irish fatherly reassuring way, reminded me that “we Irish are usually our own worst enemies“.

But my most formative time was when I joined the International Division in a section assigned to work on the international business of U.S. multinationals and my boss was John Zutter, who later ran the bank's London branch. It was John who insured that I learned that side of the bank's business, which really helped in my subsequent position. Because of John, in steps that I did not know about at the time, in 1981 I was assigned the global relationship management responsibilities for General Motors and its subsidiaries, when John McGillicuddy created that program for MHT. There was no application process for that, and no communication about what was happening, and it was only because of John that I got that opportunity. Of the approximately 20 relationships assigned to this program, General Motors was arguably the most successful and ultimately resulted in the bank, then Chemical, arranging the largest global syndicated loan in the world to that date in1993. That was a situation where the talents of Jimmy Lee, and his formidable syndicated loan group, combined beautifully with the deep relationship that Manufacturers Hanover was able to establish and cultivate. Neither could have done it without the other. Jimmy and his crew also taught me a lot during that six-month process, but John Zutter is the one to whom I owe so much for the ultimate success of my career.