A Moment in Bank History

Chemical's Real Estate Portfolio Exposure, 1975

By Jon Salony

It was in spring of 1975, Chemical, looking to expand its banking operations, floated a $100MM bond. It was a successful offering, but then the bad news hit. During the due diligence period, an investor questioned the health of the bank's real estate portfolio, particularly its exposure to the REIT industry. Back then, portfolio details were not that robust. When it became apparent that disclosure could have been better, the bank, in a highly unusual move, pulled the offering from the market. That began an investor dive into Chemical's real estate portfolio as well as other money center banks.

It was in spring of 1975, Chemical, looking to expand its banking operations, floated a $100MM bond. It was a successful offering, but then the bad news hit. During the due diligence period, an investor questioned the health of the bank's real estate portfolio, particularly its exposure to the REIT industry. Back then, portfolio details were not that robust. When it became apparent that disclosure could have been better, the bank, in a highly unusual move, pulled the offering from the market. That began an investor dive into Chemical's real estate portfolio as well as other money center banks.

Six months earlier, the roots of the banking system were badly shaken when Franklin National Bank, a regional institution on Long Island, failed as a result of the inability of its holding company to redeem commercial paper due in part to concerns about real estate lending risk. As the biggest failure at the time, attention then turned to the health of the banking system in general. Next in the spotlight was Chemical. Of course the bank was in better shape than the regional Franklin. All banks, money center and regionals alike, however, were impacted by excessive over-building in the real estate industry. It was sparked by over-lending on the part of banks and the real estate investment trust ("REIT") industry. How could this happen? How much was the banking industry indebted to this line of business? It raised lots of questions.

So what happened? Chemical was the first to organize a "swat team" of bankers to focus on its REIT exposure. I was selected to be a member of that group. I only had about 2 1/2 years of experience in real estate lending and about a year in corporate banking at the time. It was not a lot of experience, but the hubris of my youth probably propelled me more than anything to take on the challenges of multi-faceted loan workouts.

The stakes were much higher than I thought. We had large exposures to some very troubled companies. There were many banks involved and you could not just look out for yourself. You had to map out plans and strategies for each client as well as large and diverse lending syndicates. Bankruptcy was not a viable alternative in most situations, since we needed REIT management to remain in place to manufacture value for the lenders and investors. We travelled constantly for about two years structuring and restructuring exposures and advising and helping many banks along the way. Some of us had close contact with the Fed as many lenders in these syndicates were close to failing themselves. The REIT Crisis, mostly consisting of mortgage REITS engaged in risky construction loans, later morphed into the much safer equity REITS that we speak of today.

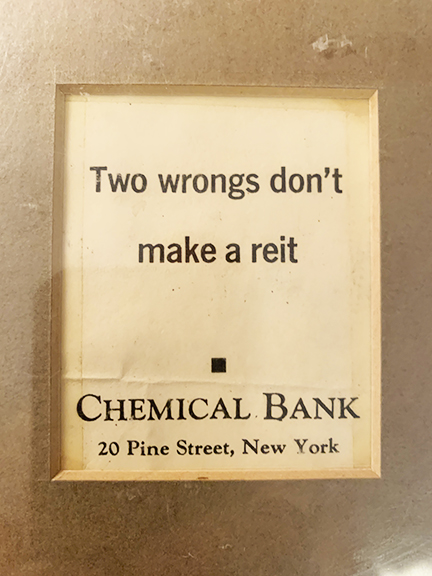

The Bond Club of New York published a popular annual five- or six-page "newspaper" called the Bawl Street Journal that would parody the financial issues of the day, in the spirit of the Harvard Lampoon and Mad Magazine. The target in 1975 was Chemical's REIT exposure. It took the form of a tombstone advertisement on the front page in the shot above.

We recently moved into a new apartment in New York City. Going through memorabilia, I found the tombstone ad and recalled that fateful parody. The good news from that era was that Chemical successfully worked its way out of the REIT crisis. Its leadership in guiding many other banks through those tough times also gave us broad credibility as an innovative leader and risk taker that would later spawn a successful investment banking platform.

It was an amazing learning experience for me to be a member of that team, and some of us get together to the fun moments fondly.

What did I do with that tombstone ad? It now has a prominent place in a bookcase in our study.

Comments

Send comments or your own "A Moment in Bank History" story to news@chasealum.org.